List of Top Blockchain Analytics Providers

Choosing a blockchain analytics provider is crucial for Travel Rule compliance. It plays a fundamental role in risk detection and management.

Below, we list the top blockchain providers and our Travel Rule solution’s already integrated providers, along with useful blockchain analytics information from its benefits to how to choose a provider.

Top Blockchain Analytics Providers

| Provider | Website | Location |

|---|---|---|

| Beosin | https://beosin.com/ | Turkey |

| Blockchain Intelligence Group | https://blockchaingroup.io/ | Canada |

| Breadcrumbs | https://www.breadcrumbs.app/ | Singapore |

| Chainalysis | https://www.chainalysis.com/ | USA |

| Coinbase Tracer | https://www.coinbase.com/compliance | USA |

| Crystal Intelligence | https://crystalintelligence.com/ | The Netherlands |

| Elliptic | https://www.elliptic.co/ | UK |

| Global Ledger | https://globalledger.io/ | Switzerland |

| Lukka | https://lukka.tech/blockchain-analytics-compliance/ | USA |

| Merkle Science | https://www.merklescience.com/ | Singapore |

| Nominis | https://www.nominis.io/ | Israel |

| Scorechain | https://www.scorechain.com/ | Luxembourg |

| TRM Labs | https://www.trmlabs.com/ | USA |

Risk Providers Already Integrated into 21 Travel Rule

Our Travel Rule solution, 21 Travel Rule, can be configured to integrate any blockchain analytics provider you choose.

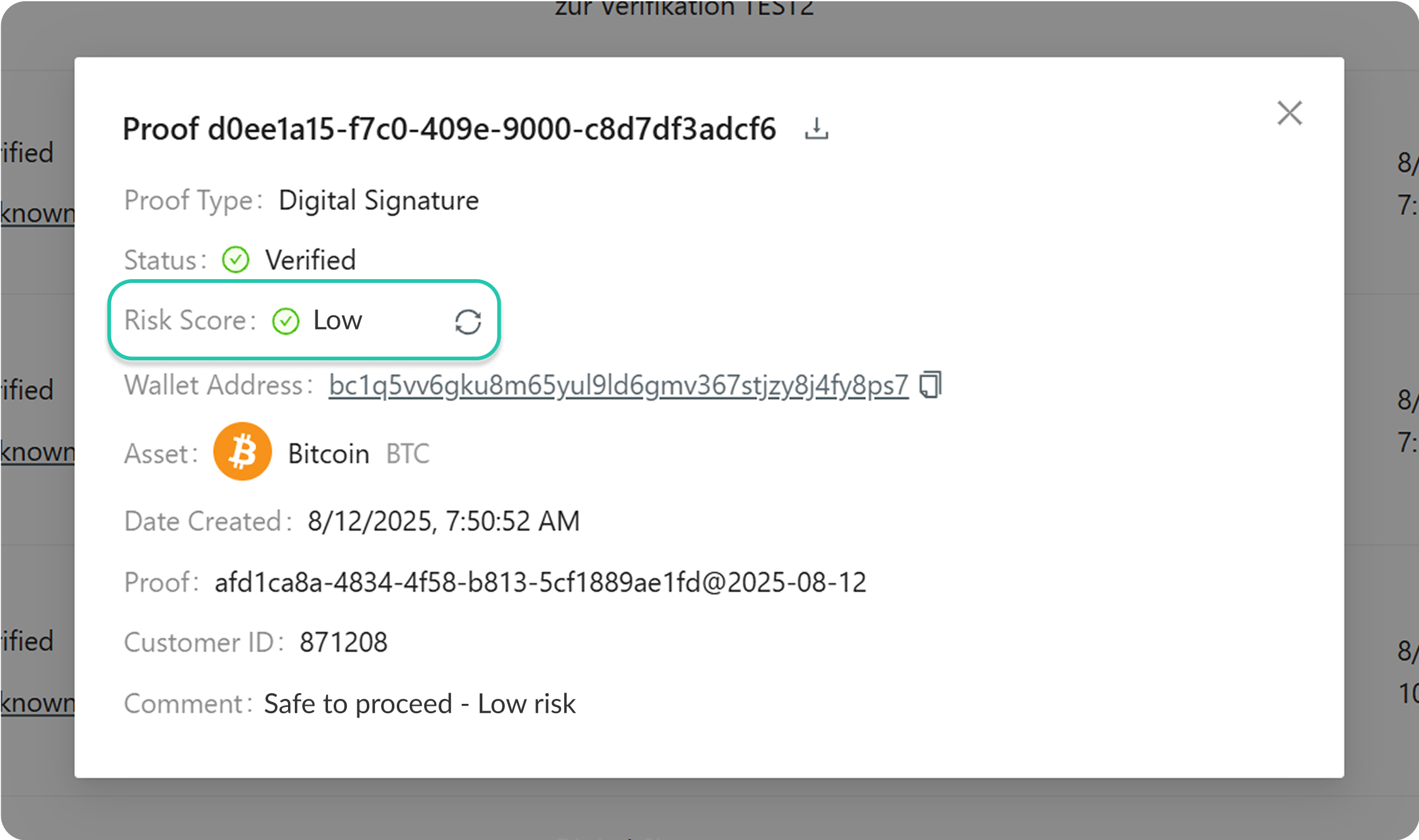

In addition to Chainalysis and Beosin, our solution comes with support for Crystal, Global Ledger and Merkle Science as integrated blockchain wallet risk providers.

See risk scores provided in real time. Contact us for more information.

Blockchain Analytics Explained

Blockchain analytics works in 4 ways: clustering, identifying, risk scoring and visualisation.

1. Clustering:

Clustering simplifies the public ledger by grouping related wallet addresses together, making it easier to understand a wallet’s activities.

2. Identification:

After clustering related wallet addresses, identification occurs. Identification methods can vary between blockchain analytics providers, but the end goal is to link an entity to the addresses they use or control.

3. Risk Scoring:

After clustering and identification, a risk score is assigned to the wallet address based on its activity, i.e. counterparties, transaction patterns, and/or connections to illicit activity.

4. Visualisation:

In this step, an investigator can track the transactions and how they move across wallets and services. For example, do the assets come from questionable sources, like Darknet Markets?

Blockchain Analytics Is Essential for Travel Rule Compliance

Blockchain analytics is essential because it transforms raw blockchain data into actionable intelligence, enabling transparency, trust, and security across the crypto ecosystem.

For law enforcement and regulators, it helps trace illicit funds, uncover money laundering schemes, and verify compliance with AML and FATF Travel Rule standards.

Businesses such as exchanges and fintech companies rely on it to assess counterparty risk, prevent transactions with sanctioned or high-risk wallets, and maintain regulatory compliance, protecting both their reputation and operating licences.

Beyond compliance, blockchain analytics supports market intelligence, strengthens security by identifying attack patterns, and demonstrates that cryptocurrency can be safer and more transparent than cash when properly monitored.

In short, it’s the backbone of a trustworthy digital asset environment, making crypto harder for criminals to exploit and easier for legitimate adoption to grow.

How to Choose a Blockchain Analytics Provider

As mentioned above, blockchain analysis aims to aid digital asset companies in assessing the risks associated with their digital asset transactions; therefore, it is essential to understand the regulations within your jurisdiction before proceeding.

On top of this, the following guiding questions need to be considered when choosing a provider.

1. Which Screening Services Are Offered?

Screening services should include VASP, wallet and transaction screening.

VASP screening protects you from businesses that could expose you to risks. An example would be a financial institution that does not have proper compliance controls in place.

One of the benefits of wallet screening is that you can ascertain whether the wallet carries a risk before sending any funds.

Transaction screening allows you to review a transaction's origin, which helps avoid transactions from sanctioned jurisdictions.

2. Are the Compliance Regulations of Your Region Covered?

As a VASP, you must know which regulations are active in your region and ensure you comply with them. Before choosing your provider, ensure they are following these regulations and are compliant with them.

3. Is there a Report and Record-Keeping functionality?

Record keeping and monitoring are essential for complying with crypto regulations. It is important to verify the duration of these records, as the time period varies depending on the jurisdiction. For example, the FATF recommends 5 years, but Dubai’s VARA mandates 8 years.

4. Is Training Provided?

Does the provider offer training to compliance officers who use the product? Is the training free? Is it paid for? What other training opportunities does the provider offer?

Do you have a question that wasn’t covered in this text?

Let us know, and we will gladly provide guidance on the topic.