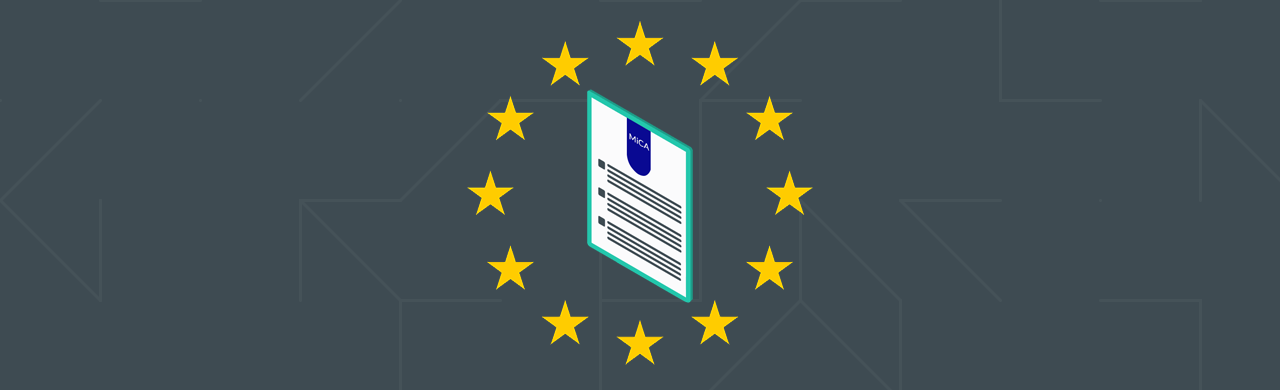

What Is The Markets in Crypto Assets (MiCA) Regulation?

On 5 October 2022, we saw European Union (EU) officials agree upon the final version of the Markets in Crypto Assets (MiCA) framework. Now that the agreed text has been released, we have a clearer idea of what MiCA entails and the expectations of the EU.

Let’s dive in.

When Will MiCA Be Enforced?

It is predicted that the complete MiCA framework will be published in the Official Journal of the EU by April 2023 latest. Twenty days thereafter, it will come into force - e.g. when it effectively starts to have legal existence in the European Union. However, the regulation starts to apply - e.g. when it can start to produce legal rights and obligations and can be directly enforced towards courts - the earliest at 12 months after entry into force. Different parts of the regulation begin to apply at different points in time. It is predicted that issuers of electronic money tokens (EMTs) and asset reference tokens (ARTs) have until April 2024 (12 months) to meet compliance requirements.

Whereas crypto assets service providers (CASPs) and issuers of crypto assets, excluding ARTs and EMTs, will have until October 2024 (18 months) to comply.

MiCA’s ramifications should be felt globally due to the EU’s economic clout. It is expected that other countries will swiftly follow suit and implement the Travel Rule or variations thereof.

Any person or entity providing crypto asset services in Europe, for example, crypto exchanges and all crypto assets not already subject to the EU regulation, will fall under the Markets in Crypto Asset Regulation (MiCA).

What Are MiCA’s Objectives?

MiCA has 4 main objectives:

1. Provide legal certainty for all crypto assets that were out of scope or not covered by existing EU financial services legislation

Lawmakers noted that there were certain gaps within European financial service regulations. In an attempt to remedy this, the MiCA framework was drawn up. The framework covers assets, markets, and service providers (like CASPs, or as per the FATF - VASPs)

2. Replace existing crypto asset national frameworks not covered by existing EU financial services legislation

MiCA aims to create a framework that supports the development and application of new technology while addressing and managing all risks associated with virtual assets in the present and the future. Most importantly, MiCA creates an even playing field at the union level, making the rules clearer for entities anywhere in the EU, reducing regulatory arbitrage.

3. Establish specific rules for “stablecoins”

MiCA provides a layer of protection for consumers and regulates crypto assets that were out of scope or not covered within the EU’s initial financial services legislation. While stablecoins are still moderate in size, their growing popularity could lead to potential risks in the future if they are not correctly governed.

4. Establish a singular set of rules for CASPs and token issuers

MiCA will also level out the playing field for CASPs. Until recently, regulators did not have a common framework to turn to, and many regulators were deemed too harsh in their decisions. These decisions led to CASPs and customers being negatively impacted by these rulings in certain member states. In some cases, this resulted in a loss of business and/or funds.

What Falls under MiCA’s Scope

Unlike the Financial Action Task Force’s (FATF’s) Recommendations and the Transfer of Funds Regulation (TFR), MiCA does not tackle anti-money laundering (AML) risks. It was designed to align EU legislation with the FATF’s Recommendations. This includes the terminology and scope of the regulations to a certain degree.

It is anticipated that MiCA and the TFR will come into effect simultaneously.

MiCA does not cover DeFI and DAOs, provided the protocol or organisation is 100% decentralised. MiCA only regulates centralised entities. All fully decentralised protocols are excluded from MiCA’s scope.

If an entity claims to be decentralised and is not, the organisation will be held responsible under MiCA, since the regulation takes a substance over form approach.

Read: 5 Ways To Tell If a Protocol is Decentralised.

Non-fungible tokens (NFTs), in theory, are also not part of MiCA, provided they are “unique and not fungible with other crypto assets”.

Lastly, the lending and borrowing of crypto assets do not fall under MiCA’s watch.

MiCA will apply to all EU member states once it is adopted and all foreign businesses interested in doing business within the EU.

MiCA’s New Definitions

The MiCA proposal has also introduced and modified 28 crypto asset definitions. Through these implementations, further guidance can be given: definitions can be future-proofed to ensure all actors in the crypto ecosystem are equally protected and no gaps are left unfilled.

In a previous blog, Stablecoins Are No More: MiCA’s EMTs and ARTs Explained, we defined EMTs and ARTs, explained their capabilities and capped amounts, and explained their relevance to the stablecoin ecosystem.

Below are additional important definitions that MiCA has coined. Please refer to Article 3 in the MiCA framework for a complete list of updated terms.

As per Article 3:

Crypto assets are “a digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology."

Utility tokens can be defined as “a type of crypto-asset which is intended to provide digital access to a good or service, available on DLT, and is only accepted by the issuer of that token.”

Furthermore, MiCA’s definition of a CASP and its activities is broader than the FATF’s VASP.

A crypto asset service provider is “any person whose occupation or business is the provision of one or more crypto-asset services to third parties on a professional basis.”

As per MiCA, CASP activities include

The custody and administration of crypto assets on behalf of third parties,

The operation of a trading platform for crypto assets,

The exchange of crypto assets for fiat currency that is legal tender,

The exchange of crypto assets for other crypto assets,

The execution of orders for crypto assets on behalf of third parties,

The placing of crypto assets,

The reception and transmission of orders for crypto assets on behalf of third parties,

Providing advice on crypto assets.

Whereas the FATF defines a VASP as “any natural or legal person who is not covered elsewhere under the Recommendations, and as a business conducts one or more of the following activities (stated below) or operations for or on behalf of another natural or legal person”

The exchange between virtual assets and fiat currencies,

The exchange between one or more forms of virtual assets,

The transfer of virtual assets,

The safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets,

The participation in and provision of financial services related to an issuer's offer and/or sale of a virtual asset.

What Isn’t Covered by MiCA?

MiCA has specified that in certain circumstances, there are exceptions to its coverage, one reason being that these areas are already defined in existing legislation.

For the full list of exceptions, please see Article 2 of the Regulation on Markets in Crypto Assets.

Below are some examples of what MiCA does not apply to:

"persons who provide crypto-asset services exclusively for their parent companies, for their own subsidiaries or for other subsidiaries of their parent companies;

a liquidator or an administrator acting in the course of an insolvency procedure, except for the purposes of Article 47;

the ECB, central banks of the Member States when acting in their capacity as monetary authorities, or other public authorities of the Member States;

the European Investment Bank and its subsidiaries;

the European Financial Stability Facility and the European Stability Mechanism;

public international organisations."

NFTs that are unique and not fungible with other crypto assets.

The MiCA framework is an extensive document with the end goal of providing a level playing field for financial institutions and CASPs across the EU. Through its uniform approach, actors within the ecosystem can expect an additional layer of protection and equality.