Switzerland’s 2024 National Risk Assessment (NRA)

Recently, the Swiss Federal Council released its National Risk Assessment (NRA) Risk of money laundering and the financing of terrorism through crypto assets.

The extensive document discusses the risk of money laundering (ML) and financing terrorism (TF) through crypto assets in great detail, along with the country’s framework, Switzerland-specific risk trends, risk-mitigating factors and recommendations on moving forward.

Due to the in-depth nature of the original document, this blog will focus on the National Legal Framework (section 4.6), providing a summary of each section. The article concludes with 21 Analytics’ opinion on what Switzerland’s ecosystem growth and regulatory robustness mean to ecosystem players.

The National Legal Framework

In 2018, Switzerland implemented its Travel Rule. The Swiss regulator, FINMA, was one of the first regulators to issue its own guidance - a more stringent version of the Financial Action Task Force’s (FATF) Travel Rule. The existing Swiss ML/TF regulatory framework was modified to include virtual assets (VAs) and virtual asset service providers (VASPs), stipulating that all activities involving VAs would fall under the Anti-money Laundering Act (AMLA).

Overview of VA Services that Fall under AMLA

The following categories of VA services fall under AMLA:

Token emission activities like ICOs (if the token issued can be equated with a means of payment).

Custodial wallet providers, like exchanges.

Non-custodial wallet (self-hosted wallet) providers are subject to AMLA, except in peer-to-peer transactions.

Download Transacting with Self-hosted Wallets as a Swiss VASP

Online currency exchange platforms.

Currency exchange offices, like bitcoin ATMS.

Centralised trading platforms.

Decentralised trading platforms and decentralised finance (DeFi) applications require authorisation if they involve a financial market activity, following an economic-based criterion.

Interpretation of the Travel Rule in Switzerland

Article 10 of AMLO-FINMA mandates financial institutions (FIs) to share originator and beneficiary identification data for every transfer order, whether it involves traditional currencies or VAs. This sharing of information enables the beneficiary FI to verify if the sender is sanctioned and confirm the accuracy of recipient details.

Compliance with this rule aligns with FATF's 2019 standards, including the Travel Rule, which requires VASPs to adhere to preventive measures. FIs with VASP activities can only send VAs to known customer addresses and receive VAs from such addresses. If the originator and beneficiary data cannot be securely transmitted, FIs cannot accept VAs from other institutions or send VAs to clients of different institutions.

Download the Swiss Travel Rule Overview by EY and 21 Analytics

ICOs, Stablecoins and DeFi

In 2018, FINMA issued guidance on initial coin offerings (ICOs), clarifying how investors fund ICO organisers and receive blockchain-based tokens, categorised as payment, utility, or asset tokens. ICOs involving payment tokens are subject to AMLA regulations, requiring individuals or entities acting as FIs to obtain a supervisory licence from FINMA or join a self-regulatory organisation (SRO) in Switzerland.

Thereafter, in 2019, FINMA observed a rise in stablecoin projects and issued additional guidelines for their assessment under Swiss supervisory laws, adopting a technology-neutral stance and categorising stablecoins based on underlying assets.

Stablecoins are categorised based on underlying assets and are typically subject to AMLA regulations due to their payment function. When supervised institutions issue stablecoins on open-access platforms like Ethereum, heightened ML and reputational risks are a concern. Due diligence obligations under the AMLA can only be fulfilled for the first and last holders of stablecoins, as those in between are beyond the issuing institution's control, posing potential reputational damage to the institution and the Swiss financial market. To mitigate these risks, supervised institutions must implement contractual and technological restrictions to identify all stablecoin holders.

Additionally, for DeFi applications, FINMA applies existing financial regulations, monitoring trends closely and applying principles of substance over form and “same risks, same rules” to supervised entities, regardless of the technology used.

The DLT Act

On 25 September 2020, the Swiss Parliament passed the Federal Act on the Adaptation of Federal Legislation to Developments in Digital Ledger Technology, amending ten existing federal acts, including AMLA.

Notably, the scope of the AMLA was expanded, with DLT trading facilities defined as financial intermediaries. The Financial Market Infrastructure Ordinance (FinMIO) prohibits DLT trading facilities from accepting assets that could complicate AMLA compliance or compromise financial system stability.

Additionally, AMLO now considers service providers assisting in virtual asset transfers as financial intermediaries, including wallet providers and decentralised trading platforms. These amendments aim to address increasingly decentralised asset transfer models, ensuring clarity on the AMLA status of virtual assets issued in ICOs and aligning Swiss regulations with FATF recommendations for a broad interpretation of VASPs.

FINMA’s Actions since 2019

FINMA has been increasingly focused on crypto-specific risks since 2019, establishing various conditions, requirements and licensing processes to be met for orderly business development in the Swiss crypto ecosystem. Moreover, FINMA established strict criteria and control processes for operational risks and has addressed the elevated IT and cyber security risks.

In 2021, FINMA analysed and reviewed the planned business activities of banks for money laundering compliance, followed by clarification of expectations by adding a sixth module to existing AML audit modules covering VAs and VASPs.

In January 2021, the threshold for identifying counterparties in currency exchange lowered from CHF 5000 to CHF 1000 in line with the FATF's Recommendation 15. Last January, the partially revised AMLO came into force, specifying a CHF 1000 threshold for cash payments or receipt of anonymous means of payment for virtual currency sales or purchases, with financial intermediaries being required to implement technical measures to prevent threshold breaches within 30 days.

Switzerland’s Crypto Ecosystem Is Thriving

While the National Risk Assessment (NRA) Risk of money laundering and the financing of terrorism through crypto assets, provides helpful conclusions and recommendations that should be heeded, there is more to the Swiss ecosystem that should be noted.

Switzerland emerged as an early participant in the virtual asset space, with many blockchain institutions like Ethereum and Tezos choosing it as their base. Moreover, Switzerland was one of the first regions to publish their own guidance on the application of the FATF’s Travel Rule and successfully implement it in 2019, bolstering regulatory robustness and instilling confidence within the blockchain ecosystem.

Evidence of this confidence can be found in the substantial growth of FIs who conduct VASP activities in the jurisdiction. Switzerland reported less than 10 FIs operating in this field in 2018; at the end of 2022 this number had shot up to 204.

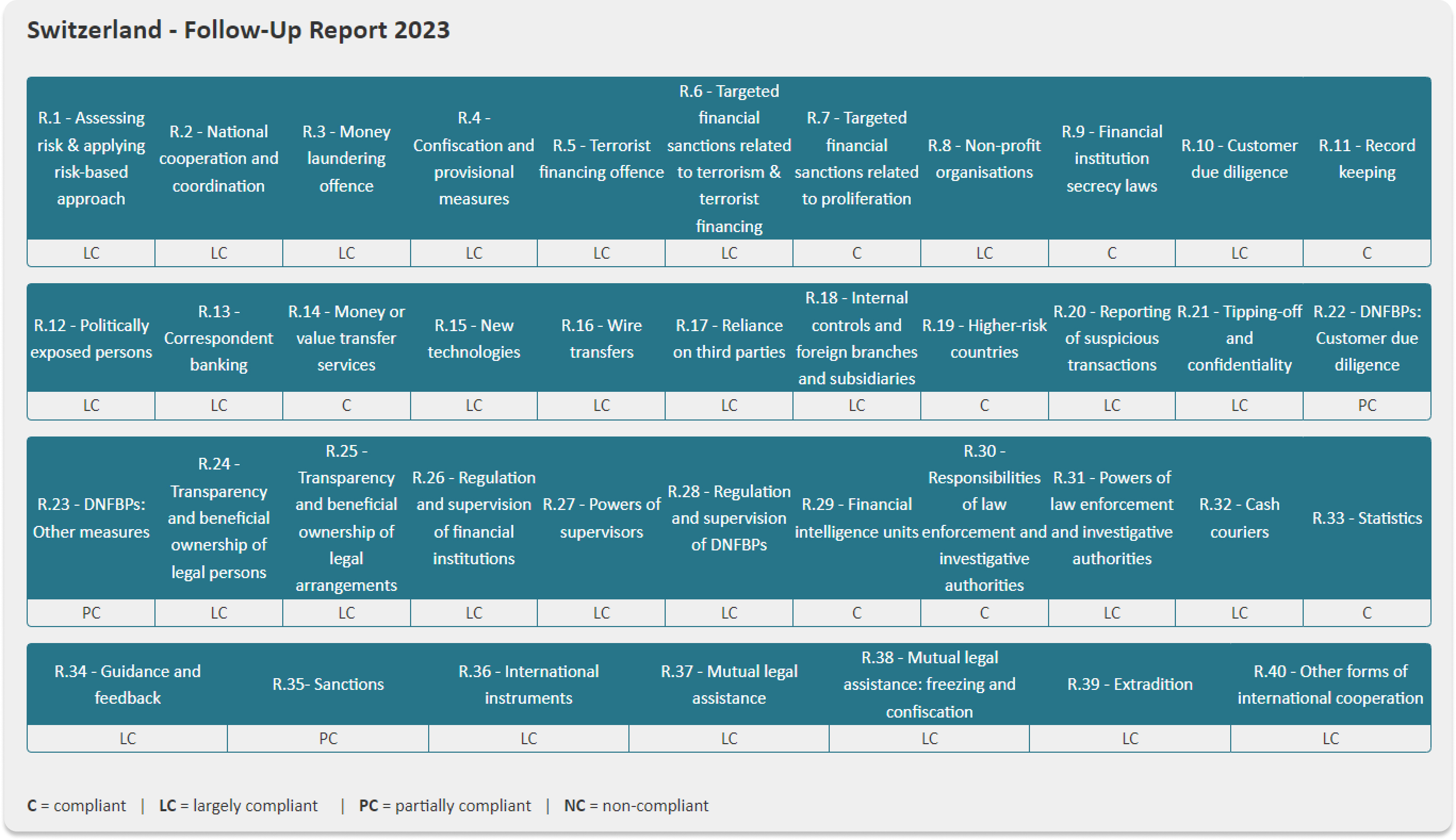

The Swiss ecosystem is thriving, with politicians embracing blockchain technology, cities like Lugano enabling citizens and companies to pay taxes with cryptocurrency, Swiss banks offering accounts to crypto companies, and the country recently receiving a rating of Largely Compliant rating with most of the FATF’s Recommendations. These are just some examples of Switzerland’s successes in the digital arena.

What Does this Mean for Financial Institutions?

Due to Switzerland’s clear and “older” regulatory framework, VASPs are provided with legal certainty and clarity on compliance requirements. FIs entering the Swiss ecosystem can be assured of a conducive operating environment with the required support to meet compliance standards with ease, unlike other regions that are still finding their footing. The country is a hub for blockchain innovation, with a strong ecosystem of blockchain startups, research institutions, and industry players.

Switzerland's political stability and strong international connectivity make it an ideal location for businesses looking to access global markets and establish international partnerships.

FIs looking to start their crypto venture in Switzerland are on the right track. Reach out to us - we can assist you in your crypto business journey by linking you up with ideal legal, compliance, accounting, or banking partners that suit your requirements.