Quick Guide: The FATF Travel Rule in Under 5 Minutes

TL;DR

The FATF Travel Rule, introduced in 2019 under Recommendation 16, extends anti-money laundering and counter-terrorist financing rules to virtual assets and VASPs.

It requires VASPs to verify and share key customer information (like names and account numbers) during virtual asset transfers, including those involving self-hosted wallets.

The Travel Rule’s primary goal is to prevent illicit use of virtual assets by enabling law enforcement and financial authorities to track and investigate suspicious transactions, thereby enhancing global financial transparency and security.

What Is the FATF Travel Rule?

In 2019, the Financial Action Task Force (FATF) extended its anti-money laundering and counter-terrorist financing (AML/CFT) standards to include virtual assets and virtual asset service providers (VASPs). This extension is part of Recommendation 16, widely known as the Travel Rule.

This expansion's main purpose is to prevent criminals and terrorists from exploiting virtual assets to move illicit funds. Since the introduction of the Travel Rule, the FATF has conducted three reviews to monitor how effectively its guidance on virtual assets and VASPs is being implemented.

Under Recommendation 16, VASPs are required to collect, verify, and transmit specific customer information when processing virtual asset transfers. These obligations also apply to transactions involving self-hosted wallets, with clear compliance procedures outlined.

What Customer Information Does the Travel Rule Require?

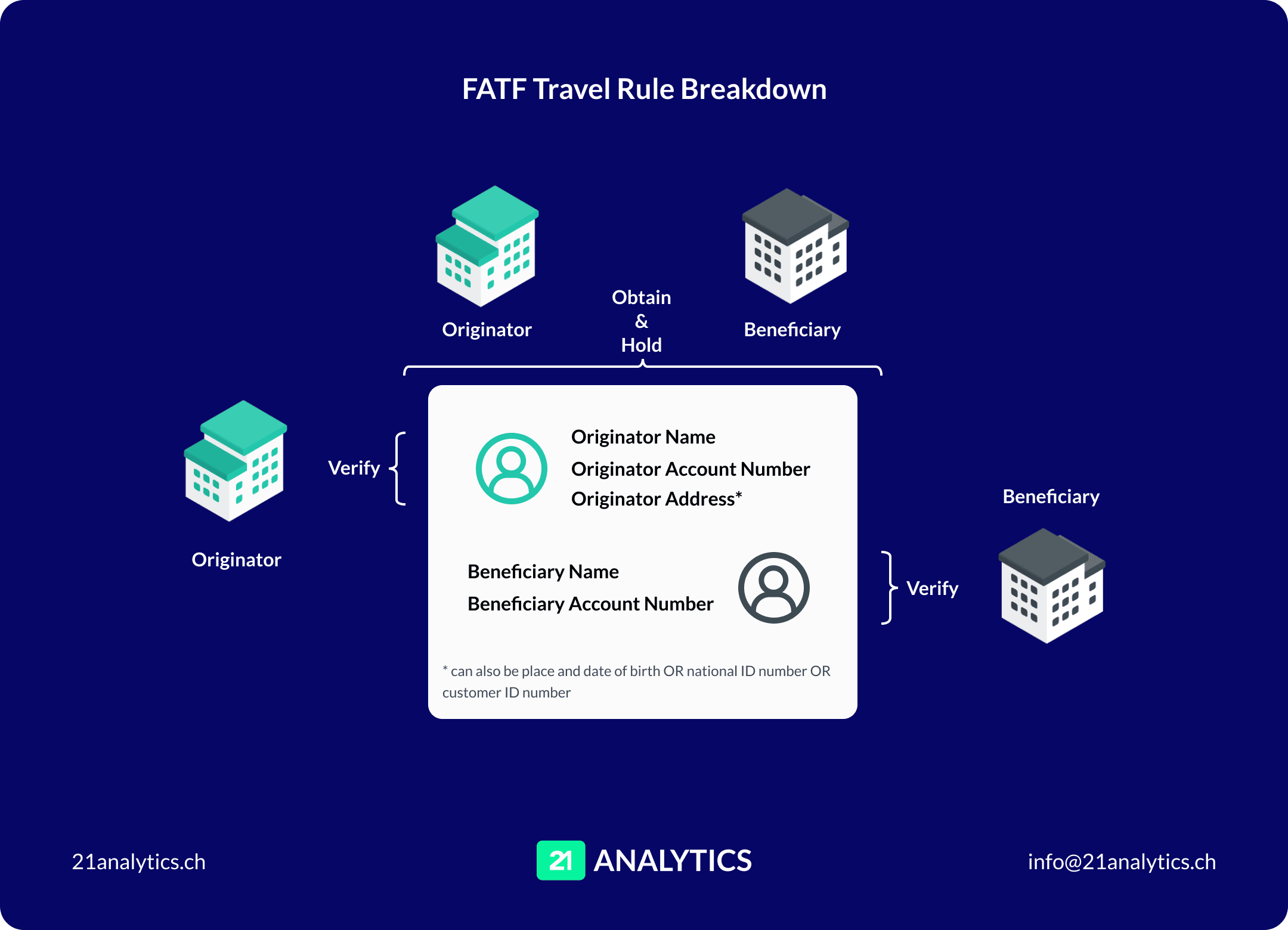

Under Recommendation 16, commonly known as the FATF Travel Rule, specific information must be verified and transmitted between VASPs during a virtual asset transfer.

Responsibilities of the Originator VASP

Before initiating a transaction, the originator VASP must obtain and verify the following details:

Originator’s name

Originator’s account number,

One of the following identifiers: the originator’s physical address, national identity number, customer identification number, or date and place of birth

Responsibilities of the Beneficiary VASP

Before receiving the transaction, the beneficiary VASP must verify:

Beneficiary’s name

Beneficiary’s account number

While verification is a key component of the Travel Rule, successful implementation also requires that this information be securely transmitted from the originator VASP to the beneficiary VASP and appropriately stored for recordkeeping and regulatory purposes.

Why Does the Travel Rule Exist?

The Travel Rule plays a vital role in the global effort to combat money laundering and terrorism financing. By requiring the exchange of originator and beneficiary data, it supports the following key objectives:

Enabling law enforcement to detect, investigate, and prosecute criminal and terrorist activity and trace illicit assets.

Supporting financial intelligence units in monitoring suspicious or unusual transactions.

Allowing VASPs and financial institutions to identify and report suspicious behaviour, freeze assets, and prevent dealings with sanctioned individuals or entities.

Ultimately, the Travel Rule is designed to enhance transparency and accountability in virtual asset transactions, reinforcing the security of the global financial system.

Source: The FATF Recommendations. Financial Action Task Force

Travel Rule Implementation Timeline

Further Reading and Sources