Everything VASPs Need to Know About the FATF Travel Rule

New regulations can have deep impacts on financial institutions' operations, and virtual asset service providers (VASPs) are no exception. With the mainstream adoption of cryptocurrencies, awareness becomes key to avoid the costs of neglecting compliance.

Moreover, with the global increase in criminal and terrorist misuse within the virtual asset sector, the Financial Action Task Force (FATF) put forward Recommendation 16 (the Travel Rule).

Upon implementation, Recommendation 16 acts as a regulatory framework that VASPs must adhere to when executing virtual asset transfers. As outlined in Recommendation 16, VASPs are mandated to gather, verify, and exchange specific customer information before facilitating any virtual asset transfer. Additionally, it outlines the protocols governing transactions involving self-hosted wallets.

What Is the Objective of the Travel Rule for Virtual Assets?

The purpose of the Travel Rule is to prevent criminals from being financed and moving their funds in anonymity. This is achieved by tracing transfers and allowing information on the involved people to be available for authorities and financial institutions. The tracing is executed through the exchange of personal data between VASPs, which enables them to store, analyse and communicate suspicious activities to authorities combating financial crimes.

Who Must Comply with the Travel Rule?

In 2019, the FATF recommended that the Travel Rule apply to VASPs for both fiat and virtual asset transactions. It was determined that the Travel Rule is to be implemented if

the transactions involve a traditional wire transfer or

a virtual asset transfer between a VASP and another obliged entity or

a virtual asset transfer between a VASP and a self-hosted wallet.

The latter two points were recently included in the 2021 FATF's revised guidance on a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers.

What Is a VASP?

According to the FATF, a VASP is an entity who conducts one or more of the following activities on behalf of its customers:

exchange between virtual assets and fiat currencies;

exchange between one or more forms of virtual assets;

transfer of virtual assets;

safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets; and

participation in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset.

Does the Travel Rule Apply to All Transactions?

Each country decides if there will be a threshold and the maximum amount of a transaction that does not require collection, storage, and exchange of FATF Travel Rule information.

For example the Travel Rule applies to all transactions in Switzerland and Liechtenstein, regardless of their value.

Does the Travel Rule Apply to Self-hosted Wallets?

Firstly, these wallets are generally regarded as posing higher risks. Additionally, when a VASP receives a deposit from a self-hosted wallet, it must collect identical data as it would in a VASP-to-VASP transaction, therefore the updated guidance from the FATF allocates a distinct section, 179 and 180, to self-hosted wallets.

This entails obtaining the originator's information, although it may remain unverified. The beneficiary data should also be sourced from the originator. Requirements for self-hosted wallets vary across jurisdictions. For instance, Liechtenstein mandates enhanced due diligence for transactions involving self-hosted wallets, requiring wallet owners to furnish proof of ownership. Conversely, the implementation of the Travel Rule in the US does not encompass self-hosted wallets.

Read more about self-hosted wallet verification methods.

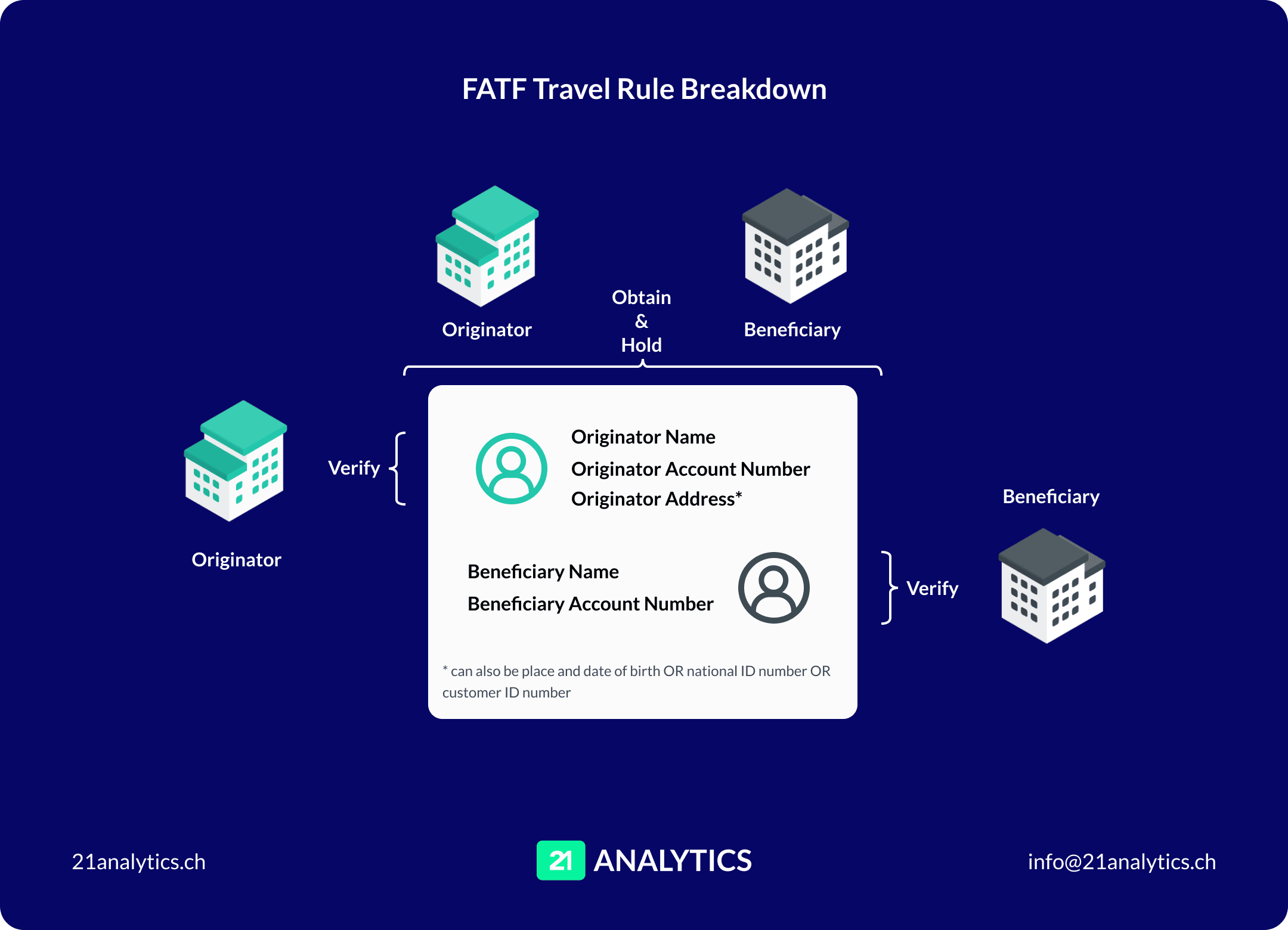

What Is the FATF's Requirements for Travel Rule Information to Be Exchanged?

1. The name of the originator (person sending funds);

2. the originator account number or unique transaction identifier

3. the originator’s address, or national identity number, or customer identification number, or date and place of birth;

4. the name of the beneficiary (person receiving funds); and

5. the beneficiary account number or unique transaction identifier.

This data must be sent accompanying the transfer to the receiving company.

The FATF Travel Rule brings challenges to VASPs, such as knowing where to send the information and how to communicate it. A range of different protocols, like TRP, have been developed to solve these demands.

Our software solution, the 21 Travel Rule, supports leading protocols for a seamless compliance experience to VASPs anywhere in the world.

Contact us to learn more and see our solution in action.